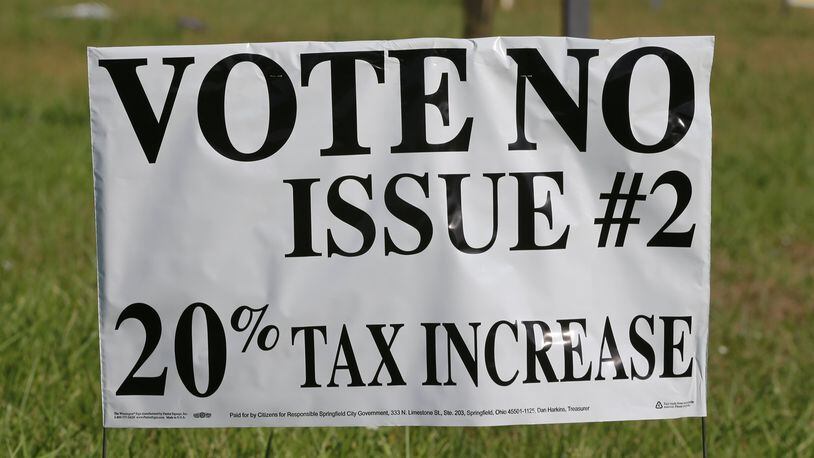

PRIOR COVERAGE: Springfield leaders say tax hike needed, opponents say it's too much

The complaint alleges the Board of Elections received reports of a $500 donation to the committee from AFSCME Ohio Council 8 on Sept. 30 and another $500 donation from Dayton-based McGohan Bradender Agency Inc. on Oct. 7 – but those were never reported by the committee.

Expenditures for campaign materials purchased by the committee posted in Springfield also weren’t reflected in its campaign report, the complaint alleges.

RELATED: Springfield reschedules budget meeting

Violation of election falsification is a fifth-degree felony, according to the Ohio Revised Code.

Springfield will likely cut services and some police officers may be pulled off the streets after voters appeared to have narrowly rejected a request to increase the municipal income tax last week.

The proposal to raise the city’s income tax from 2 percent to 2.4 percent fell short by 55 votes, according to final, unofficial results. It could face a recount — or even pass — depending on the outcome of about 1,500 provisional and absentee ballots still to be counted.

The income tax hike would have generated $6.7 million annually. For a worker making $30,000 a year, the tax would have cost an additional $9.75 per month.

About the Author