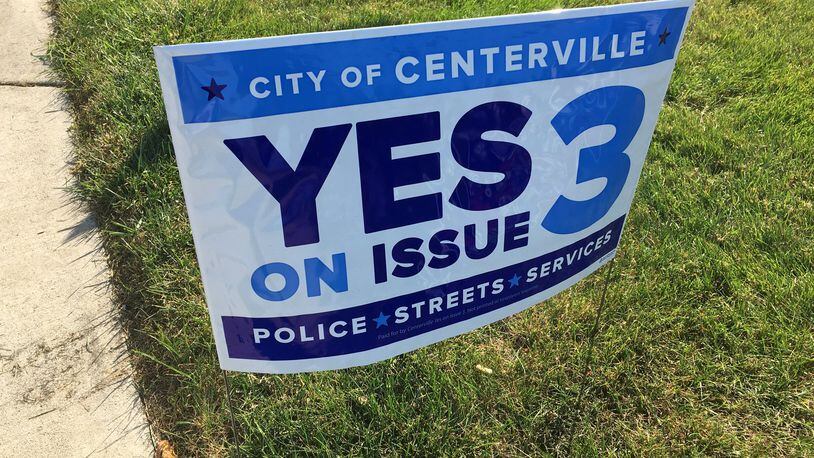

“Currently Kettering, Miamisburg, West Carrollton and Dayton have the 2.25 (earned income tax rate),” Mayor Brooks Compton said. “Oakwood and Moraine have 2.5 so we’re asking voters to increase that to 2.25 for the purpose of expenses associated with police, emergency, 911 dispatch system, road improvements and basic city services,” Compton said.

The increase will not affect social security, pensions, interest, retirement or investment accounts.

—-

On Twitter: Join the discussion on @Ohio_Politics

On Facebook: Like our Ohio Politics Facebook page and join the discussion and sound off on the issues.

—-

Centerville has lost nearly $3 million annually for the past five years due to an 89 percent reduction in state Local Government funding according to a press release from the city. The release also estimates losses of an additional $1 million in 2017. If passed, the .5 percent increase, would generate an estimated $2.2 million each year to the city. It’s the first proposed income tax issue since 1981.

Since state cuts took effect in 2011, Centerville has had to “tighten the belt,” according to Compton, eliminating or reducing the hours and pay of 14 city positions, delaying road resurfacing and increasing the cost of medical insurance for city employees, in addition to using local businesses to help generate revenue..

“Economic development is a key element of raising additional revenue and we have been trying to be very expansive as far as new businesses coming into the area, one of which is the Cornerstone development,” Compton said. “We have an economic development director who’s constantly trying to get new businesses in. The city undertook a number of aspects—one was to reduce the number of personnel that the city had. We cut that about 15 percent.”

While the people mostly affected are people who don’t reside in Centerville, about 40 percent of Centerville residents work within the city. Still, it will be up to all of the city’s residents to decide whether or not the issue passes on Nov. 8. If it does, those employed within the city would see changes to their income tax deductions starting in January 2017.

Zack Beasley, 22, who both works and lives in Centerville, said he would not be supporting the income tax increase but did acknowledge his appreciation for Centerville’s roadways and infrastructure.

“If they aren’t getting that extra money now and they seem to be doing OK, I don’t see why they would need that,” Beasley said.

Centerville resident Taylor Sullivan supports the increase.

“I plan on voting for the tax increase,” “It’s important for Centerville to maintain its quality in regards to roads, the police department and other services. I think it would definitely be beneficial for the members of the community.”

Sullivan, who works in Kettering, said those who work in Centerville but live elsewhere also benefit from the increase, even if they are the ones mostly affected.

“People who live in Centerville and work in other cities are most likely already paying a 2.25 percent earned income tax or higher for that city, so it really all balances out. Also, if you don’t live in Centerville, but drive to and from work there every day and spend time in the city, you’re reaping the benefits of the tax increase as well,” she said.

INFORMATIONAL MEETINGS

The city of Centerville has scheduled three informational meetings for voters who are unclear or undecided on Issue 3.

Monday, Oct. 24, at 6445 Far Hills Ave in the Village Center

Wednesday, Oct. 26, at the Francisan Center at St. Leonard

Tuesday, Nov. 1, in the Banquet Room at the Golf Club at Yankee Trace

All meetings will be held at 6:30 p.m.

About the Author