Most people probably have no idea that you can deduct gambling losses on your tax return; those losses - included under "Other Miscellaneous Deductions" - can be used to offset gambling winnings that have attracted the attention of the Internal Revenue Service (more on that later).

"Gambling losses include, but aren't limited to, the cost of non-winning bingo, lottery, and raffle tickets, but only to the extent of gambling winnings reported on Form 1040," the IRS guidance states.

The change in the GOP bill related to gambling losses only seems to apply to gamblers who have been taking other itemized deductions, leaving the gambling deduction in place.

"Under current law, a taxpayer may claim an itemized deduction for losses from gambling, but only to the extent of gambling winnings," states the technical explanation on the GOP tax reform measure.

Actually, bettors on horse racing had a major change take place in just the last few weeks, with a new IRS rule that revised when federal tax withholding applies after a big win on "exotic bets" at the race track, where you pick the top two, three or four horses in a race, or pick winners in several races in a row.

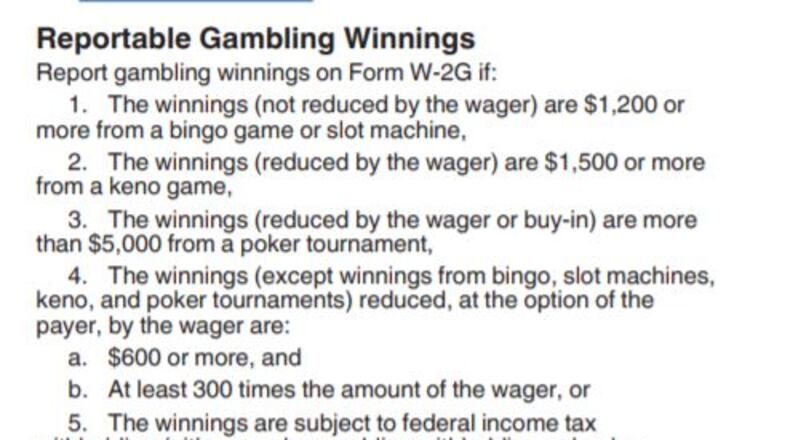

For many years, if you made such a bet on a horse race, and that ticket won you more than $600 on a $2 bet - a payoff of over 300-to-1 for that $2 bet - then you had to go to the IRS window, fill out the forms, and Uncle Sam would take a chunk of your winnings.

But if that single bet was part of a larger wager which included multiple bets involving a series of horses - like a 1-2-3-4 four horse combination for $24 - that didn't matter to the IRS, which would require you to fill out Form W2G, dealing with "Certain Gambling Winnings."

Let's see if my father can explain it.

"Heretofore, when I bet a $2 triple box and it paid over $600, I had to go to the IRS window because one of my 6 combinations paid over $600 - $2 x 300," he told me.

"Now, since my bet is for a total of $12, I will only have to go get a W-2 form if I win over 12 x 300 or $3600. That's a great break for combination players," said my father, who learned the ways of betting at the track while he was a staffer on Capitol Hill.

"The 300-to-1 criteria was calculated using the base price of the wager; it is now calculated using the total cost of the bet. That means more money in your account," read the notice to bettors from TwinSpires.com, the online betting company run by Churchill Downs, the home of the Kentucky Derby.

For those people who want to simply throw the current tax code in the trash, the rules associated with this recent regulatory change related to the gambling deduction are a good way to illustrate the bureaucratic nature of the U.S. tax code.

Here is just one part of the explanation behind how a big payoff at the track should be treated by the IRS:

" Proceeds from a Wager and Identical Wagers

"Section 3402(q)(4) provides that proceeds from a wager are determined by reducing the amount received by the amount of the wager, and proceeds which are not money are taken into account at fair market value. The current regulations provide rules for determining the amount of proceeds from a wager, including a special rule for “identical wagers.” The rule treats “identical wagers” as paid with respect to a single wager for purposes of calculating the proceeds from the wager. See §31.3402(q)–1(c)(ii)....

"The statute does not explicitly address how to determine the amount of the wager in the case of exotic wagers. Exotic wagers are those other than straight wagers. Straight wagers include bets to win (selecting the first-place finisher), place (selecting a finisher to place first or second), and show (selecting a finisher to place first, second, or third). Examples of exotic bets include multi-contestant bets, such as an exacta (selecting the first and second-place finishers in a single contest, in the correct order) and a trifecta (selecting the first, second, and third-place finishers in a single contest, in the correct order). Other examples include multi-contest bets such as a Pick 6 (selecting the first-place finisher in six consecutive contests).

"The instructions to Form W-2G provide the rule for multiple wagers reflected on a single ticket as follows: “For multiple wagers sold on one ticket, such as the $12 box bet on a Big Triple or Trifecta, the wager is considered as six $2 bets and not one $12 bet for purposes of computing the amount to be reported or withheld.” See, e.g., 2016 Instructions to Forms W-2G and 5754, at 2, available at https://www.irs.gov/pub/irs-pdf/iw2g.pdf. Thus, according to the instructions, the bettor may only consider the cost of a single winning combination when determining the amount wagered for purposes of determining whether proceeds from a wager meets the threshold for withholding in section 3402(q)(3)(C)(ii)."

Trust me, I could keep going, but you would stop reading, quickly.

This is a reminder that while the GOP plan is advertised as "tax reform," there is an awful lot of the tax code that will be left in place, which will ensure a paycheck for a lot of lawyers and accountants in the future as well.

About the Author