A law that puts more money in the pockets of hundreds of thousands of Ohioans, including those in the Miami Valley? Sign me up.

But it’s always wise to heed the German proverb “Der Teufel steckt im Detail,” which translates to, “The devil is in the details.”

The act is a complicated measure that could prove detrimental to those who don’t pay attention to those devilish details.

The No Tax on Tips Act doesn’t eliminate taxes on tips, despite what it’s called. It creates a temporary tax deduction, through the 2028 tax year, that eliminates federal income taxes on the first $25,000 in tips for some workers. Moreover, tipped employees still have to pay their share of federal taxes for social security and Medicare, as well as state and local taxes.

So, no, this isn’t “no tax on tips.”

The maximum $25,000 write-off is an “above the line” deduction, which is an adjustment to taxable income. As an example, the median salary for a server in Ohio is about $36,000, according to the Bureau of Labor Statistics. Most estimates show servers in that income range might save several hundred to a few thousand dollars a year.

That’ll help, but it’s not a windfall.

Another detail. The tips eligible for the deduction must be “reported” tips. An unreported cash gratuity doesn’t count, and the IRS estimates only 45% of tipped income gets reported, according to a U.S. Census Bureau study. Workers will have to decide whether the possible deduction is worth reporting the money upfront and paying taxes on it now.

And reporting might actually hurt tipped workers. Nationwide, more than 500,000 bartenders and servers get Medicaid, and more than 353,000 get SNAP benefits, according to the Center for American Progress. If their income exceeds certain levels, they could lose those benefits. Who would want to risk that?

Most workers aren’t going to dig into the details. They’ll see “no tax” and “$25,000” and think they have significant cash coming.

But the program will help a few people in a meaningful way. Sure, the lucky ones who earn a six-figure salary and tips will save a lot of money.

But they are indeed the lucky ones. Some 37 percent of tipped workers make so little they already don’t pay federal taxes, according to the Budget Lab.

I also wonder about the psychological impact on customers suffering from tip fatigue. Is this new law enough to make them pull back on gratuities since workers are now getting a government tax benefit?

Let’s hope not.

If the government wants to help, it should assist all low-income workers and not just one segment. But in “No Tax on Tips,” both political parties have shown they’re more interested in a catchy slogan than meaningful programs that help make the lives of the poor better. (The bill passed 100-0 in the Senate.)

This small, temporary solution can, in some cases, make lives worse when considering potential lost benefits.

“No Tax on Tips” is a nice slogan, but that’s it. “Der Teufel stecktim Detail.”

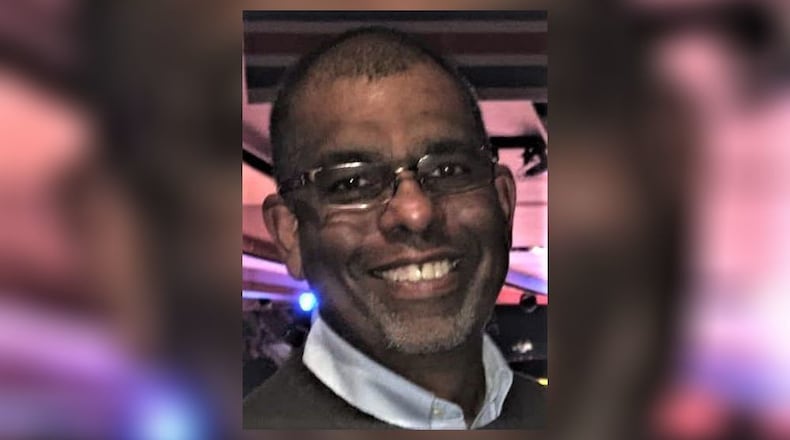

Ray Marcano’s column appears on these pages each Sunday.

About the Author