An increasing number of Americans don’t think much of going to college, according to the latest Wall Street Journal-NORC at the University of College poll. Some 56% don’t think the cost of college pays dividends. Worse, 42% of those who graduated agree, a figure that drives home the dissatisfaction of customers.

The poll tells us more about the overall feeling of college’s worth than the per-program specifics. You need a college degree if you’re going into mechanical engineering or medicine or want to become a lawyer.

But institutions have not been able to climb above the din of bad news from poll after poll that shows results that question value.

Colleges can start changing the narrative by helping students understand what their financial picture might look like when they graduate and get their first job. Institutions already provide a bevy of data to help students. Showing them their approximate costs and projected earnings for a specific degree might help freshmen or transfers better understand their financial commitment and change course early in their education career if they desire.

Students leave college with about $38,000 in federal student loan debt. Private borrowers owe about $55,000. No wonder it takes 20 years, or longer, to pay off the loan.

At 6% annual interest, that student will pay $272 a month because the federal loan, with interest, will have ballooned to $65,338. The private loan, now with a payment balance of $94,569 with interest, costs $394 monthly, according to Bank Rate’s Student loan calculator.

With that information, colleges can use data to show how much students may earn upon graduation. Let’s pick marketing, a popular college choice, as an example.

In the Dayton area, entry-level marketers make in the $40,000 a year range, based on numbers from Indeed. After taxes, that means a salary of about $2,750 a month.

Students can use that data as one point in their decision-making process. Based on this hypothetical example, a student loan repayment will take up 10% or more of after-tax income before all other expenses (car, rent, food, etc.).

This basic information has more value than the ROI education calculators that project earnings into the future. Graduating students in their 20s aren’t really thinking about the year 2063 and retirement. They want an outlook, not a guarantee, of what the rest of their 20s might look like.

Colleges would likely argue that it’s up to students and their families to determine a tolerable debt level. Institutions educate, and that’s where the obligation begins and ends. Universities can’t possibly help provide a near-term outlook because of factors beyond their control, like changes in the job market.

Worse, a young student might look at the numbers and decide a community college or vocational school to be a better bet.

Anything’s possible. But for colleges to start changing the narrative, they have to address the concerns. Simply providing big numbers that paint a rosy college picture, or marketing value, isn’t enough. Graduating seniors staring at a bloated loan sheet and an entry-level job wonder why they took this path.

That’s what you’re seeing in that 42% number.

The real advantage rests with catering to student needs. Students want an education, but they also want information. Giving them all of the information upfront might also engender a little more affinity to the institution that saw them as people and not additional revenue gained with that butt in a seat.

American history contains the tales of entire industries that failed because they wouldn’t adjust to the times. These polls, over and over, tell administrators that the public has grave concerns about college and university cost.

There’s still time to turn that around, but that time runs short.

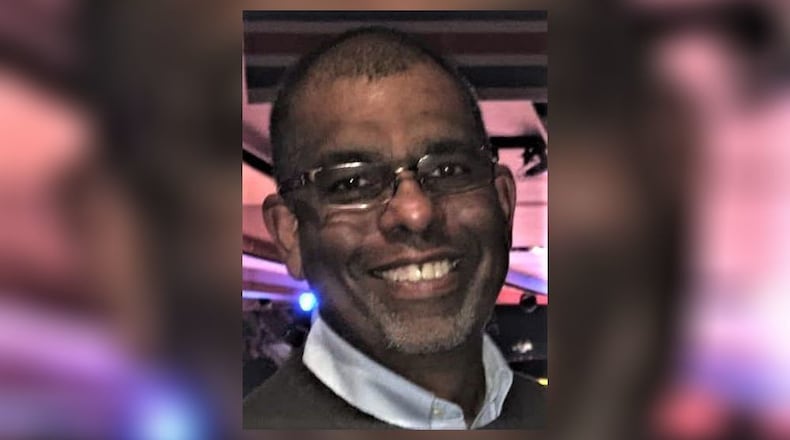

Ray Marcano’s column runs on these pages each Sunday. He can be reached at raymarcanoddn@gmail.com.

About the Author