That’s great for the small percentage of people who can weather the normal or difficult financial ups and downs.

Those numbers mask a more difficult truth. Most people have seen real wages drop over the last three years.

“For a large section of the population, the economy is worse for them than it was 20, 24, or 36 months ago,” Kevin Willardsen, an associate professor of economics at Wright State University, said.

The economy is a good example of how two things can simultaneously be true. In this case, the leading economic indicators look great, but people are struggling.

Using Federal Reserve economic data, Willardsen noted that the poorest workers — the lowest 10% of wage earners — had the strongest wage growth, an increase of 9%, between 2019 and 2022. Those earners saw their pay increase to an average of $12.57 an hour, or $26,145 annually for a full-time worker, according to the Economic Policy Institute.

That’s not the type of wage that will help someone buy a new car or a home, but it provides a little breathing room for people at the bottom of the earning scale. While that’s terrific news on the one hand — an increase is good! — it remains bad news for low-wage earners who, despite the increase, still have a hard time buying groceries (eggs, for example, increased a whopping 8.9% in December over November prices).

For many others, especially those earning in the 50th percentile and up, real wages dropped, which decreased spending power.

Willardsen broke down the trend.

In 2019, the American economy hummed along with its 10th straight year of job growth, a 3.5% unemployment rate that was the lowest in 50 years, and 30-year fixed mortgage rates, on average, under 4%.

Then COVID hit. To help compensate for lost wages, the federal government provided two stimulus checks — one under Trump and a second under Biden. When the economy began opening up, consumers spent that cash, which was another good news-bad news dichotomy.

The purchases squeezed a supply chain that still hadn’t recovered from its COVID woes. Inflation results when demand exceeds supply and prices rise. Once consumers burned through the excess cash, prices stayed elevated as real wages started to shrink.

“Roughly speaking, everybody below the median has seen either an Increase in real wages or real wages have stayed stagnant. Everybody above the median has probably seen real wage declines,” Willardsen said.

Regardless of what the numbers say, people aren’t optimistic. Just 35% believe the economy is in good shape and more than half of Americans think the economy will slow or dip into recession this year.

“We tend to fixate on things that are salient. (Two) of the most salient things are the prices of cars and houses, where you have seen astronomical growth in terms of the unaffordability of a home, especially if your reference point is 2020.”

In 2021, the average monthly mortgage payment on a $300,000 home in central Ohio was $1,137. Two years later, that loan cost $750 a month more due to interest rate increases. One survey reported that most Americans can’t afford to buy a home, which shapes their perception of the economy’s performance.

When thinking about the economy, I go back to an encounter in a local grocery store. A woman said to me that she wanted to make macaroni and cheese for her husband that night, but cheese was too expensive. She was going to buy potatoes instead.

That woman is the real measure of how the economy is doing. It’s not good.

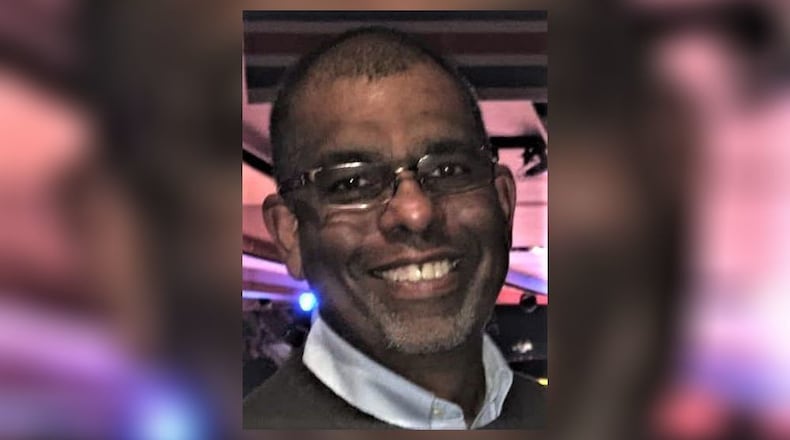

Ray Marcano’s column appears each Sunday. He can be reached at raymarcanoddn@gmail.com.

About the Author