The free services are aimed at helping people claim the federal Earned Income Tax Credit or Child Tax Credit. The credits can range in value from $519 to workers with no dependents to $6,430 for some families.

MORE: MetroParks considers options after bridge closed for safety reasons

Dayton residents also should avoid tax refund advances, Jackson said, because they are loans that can end up costing taxpayers significant sums.

“We are talking about paying to get our taxes back — why do that when it’s all your money?” she said.

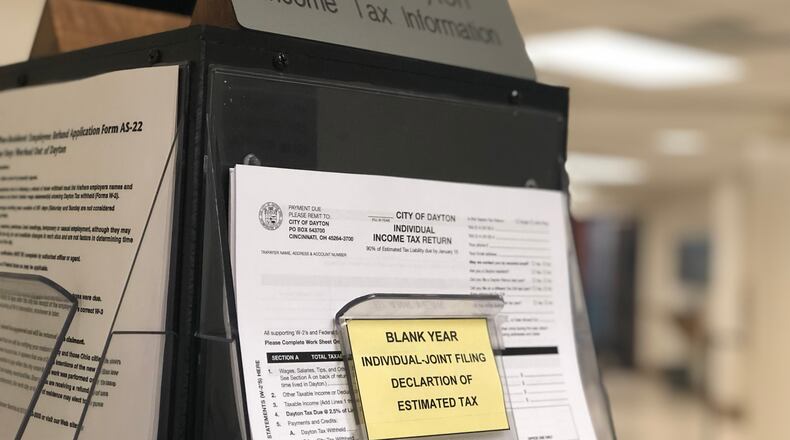

The city of Dayton, in partnership with about nine other groups, offers free tax return preparation and filing services to taxpayers earning up to $54,884.

The city spends about $15,000 to $18,000 on the program, but other groups also chip in funding.

The program, which started in 2002, connects residents with IRS-certified volunteers who last year helped local residents get back about $8 million in tax refunds, including about $1.4 million for the Earned Income Tax Credit, Jackson said.

Super Refund Saturday is coming up. Eligible taxpayers can have their tax returns done during the annual event, which will be held from 9 a.m. to 2 p.m. Saturday, Feb. 2, at the Montgomery County Job Center, 1111 S. Edwin C. Moses Blvd.

The city strongly encourages residents not to use a paid tax-return preparer if they qualify for the free service because it’s a waste of money, Jackson said.

MORE: Procrastinated on your taxes? There’s still time with these tips

Volunteers last year helped residents in Montgomery and Greene counties save around $1.8 million, based on the average fee for these services, she said.

Jackson said some people who are eligible for the program are unaware of it.

But also she said some residents want their refunds immediately and arrange for a refund advance. She said these advances are not recommended because they are loans that can be expensive.

“Save the money or use it for something else,” she said.

Some companies offer no-interest refund advances, but the funds are distributed on prepaid cards that carry fees.

There are 14 volunteer income tax assistance sites in the region: Dayton Christian Center; the Job Center; the Life Enrichment Center; Miami Valley Community Action Partnership (Dayton and Trotwood); Wesley Community Center; Dayton Metro Library E.C. Doren, Northwest and Trotwood branches; Fairborn Senior Center; Beavercreek Branch library; Beavercreek Senior Center; Greene County Xenia library; and the Miamisburg Senior Adult Center.

Some sites have walk-in hours, while some only have appointments.

Residents with questions or who want to set up an appointment with a volunteer can call United Way at (937) 913-2000.

Residents need to bring a photo ID, W-2 forms and Social Security cards or Individual Taxpayer Identification Numbers. Tax filers with child-care expenses in 2018 need to bring the provider’s information and payment documentation.

Residents who want a refund directly deposited into their savings or checking accounts will need the account numbers. For married tax filers, both parties need to be present to process the tax return.

About the Author