Americans who have not received checks have found it difficult to check the status of their payment, to find out if they are getting a payment, or to get answers from an IRS website that has been having some issues.

Here are some frequently asked questions and their answers about the COVID-19 payments.

Where is my payment?

If you filed a tax return for 2018 or 2019, receive Social Security benefits, are a veteran or have retired from railroads, then you should have received your payment or will get it within the next three weeks.

For those who filed tax returns that included direct deposit information, those payments began going out a few weeks ago as direct deposits into bank or credit union accounts.

Payments to Social Security benefits recipients, veterans and those who worked on railroads began going out last week. They are being delivered in the same way those recipients get their monthly checks.

A check will be mailed to anyone who is eligible but does not have direct deposit information or is not in one of the three categories above. The checks began to go out in late April. It is likely to take until at least September for all those checks to be distributed. Those payments are being sent out in order from lowest income to highest income.

When should I get my payment?

Click here to see key dates for those payments.

How can I track my payment?

If you have checked your account and did not find a deposit, you can go to the IRS website called "Get My Payment" to see the status of your payment.

If I’m having problems with "Get My Payment," what can I do?

"Get My Payment" has had some issues, but the IRS says it is working on smoothing out the experience.

Some people report getting hung up on entering basic information. Remember, the information must be exactly as it is on your tax return – spell out “street” if you did on your tax return, for instance. You may also want to remove any punctuation you put in.

According to The Los Angeles Times, putting your address in all capital letters has worked for some people who were having trouble getting the status of their payment.

A lot of people have gotten the "Payment Status Not Available" response. If you didn't file a 2018 or 2019 return or it hasn't been fully processed, you will get that message. Or, it could be that your return was processed but the information has yet to be transferred to the system that "Get My Payment" uses. Again, the IRS assures taxpayers it is working on the issue.

What if it went to an account number that I don’t recognize?

If the payment is routed to an account that is inactive or that has been closed, the bank will reject the deposit. The IRS will then mail a check, which will go to the address on your tax returns or the one the U.S. Postal Service has on file.

What do I do if the check is for the wrong amount?

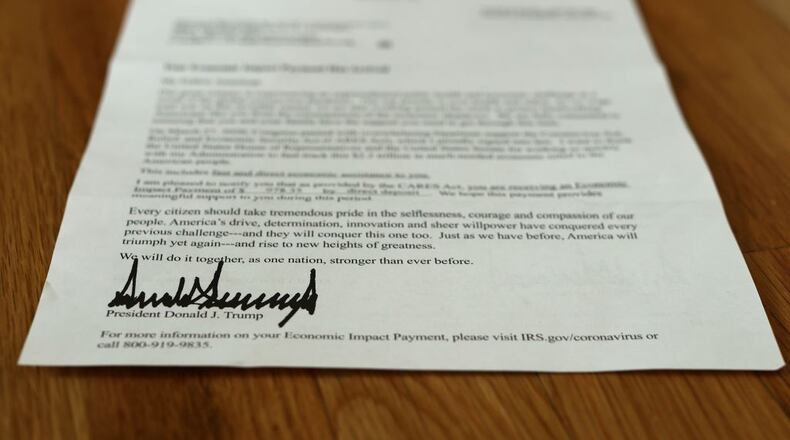

You will get a letter from the IRS about two weeks after your check has been deposited. There is information on that letter that explains the check amount and what you can do if there is a problem.

About the Author