“Some people are paying $500 a year while others are paying $5,000. Why? It could be weather in your state, your driving habits, or even your gender, marital status or credit score,” says Alyssa Connolly, director of market insights, The Zebra. “Car insurance is a major expense for most Americans, and drivers want to know how much their rates are changing – especially as new technology comes into play.”

Key findings reveal that the state of auto insurance in 2019 is:

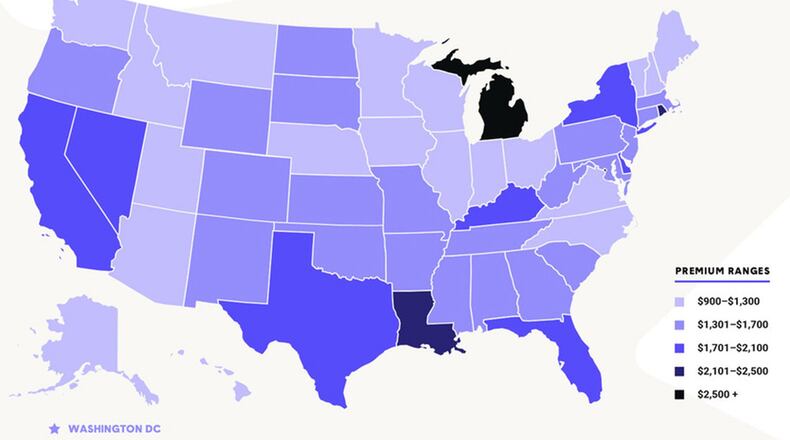

Expensive – Car insurance rates are higher than ever, with some parts of the country paying upwards of $5,000 per year.

Most expensive states:

• Michigan: $2,693

• Louisiana: $2,339

• Rhode Island: $2,110

Most expensive cities:

• Detroit, MI: $5,464

• New Orleans, LA: $3,686

• Hialeah, FL: $2,997

Erratic – Rates vary dramatically, with massive increases (and some decreases) over time, and vast disparity even within a single state.

In Colorado, car insurance costs are up 80 percent since 2011, but they’re down 20 percent in Oklahoma in the same time frame.

Rate changes from year to year have been as high as 45 percent in some states.

Even within a state, rates can vary from one zip code to another by as much as 265 percent.

Evolving – In 2019, technology is changing both how people drive and how car insurance companies operate.

Insurance companies are using telematics (apps or plug-in devices to monitor a driver’s behavior), which has the potential to lower costs for safe drivers and provide extensive data about driving trends.

Distracted drivers are starting to pay the price for their dangerous behaviors with an average insurance rate penalty of 20 percent.

Although new technology is making cars safer, it’s also making them more expensive to repair or replace, so drivers likely won’t see any car insurance savings for these new car features.

Car insurance companies are already leveraging insights from consumers’ online behavior for marketing and other purposes, and there is potential this data could inform how they price rates in the future.

About the Author