Some of the reforms should be familiar to Gov. Mike DeWine, and Huffman said after his remarks that he does not expect DeWine to veto the measures.

“These are things that reflect a lot of what his appointed folks said we should be doing,” Huffman told the Dayton Daily News. “Certainly there are some other things in there. These were all House bills, and the Senate had tweaks and additions.”

Huffman said he has seen no indication yet that DeWine will not sign the bills, something state Rep. Phil Plummer, R-Dayton, Huffman’s assistant speaker pro tempore, echoed.

“Some of those are his (DeWine’s) ideas, through his committee he put together, and actually our ideas also,” Plummer said. “I’m confident he’ll pass those. The governor does his due diligence. He listens to the schools. He does a good job vetting all of these tax cuts.”

A spokesman for DeWine said Tuesday that the governor has not received the bills yet. “We appreciate the General Assembly amending the bills to incorporate recommendations of the governor’s working group on property tax reform,” said spokesman Dan Tierney.

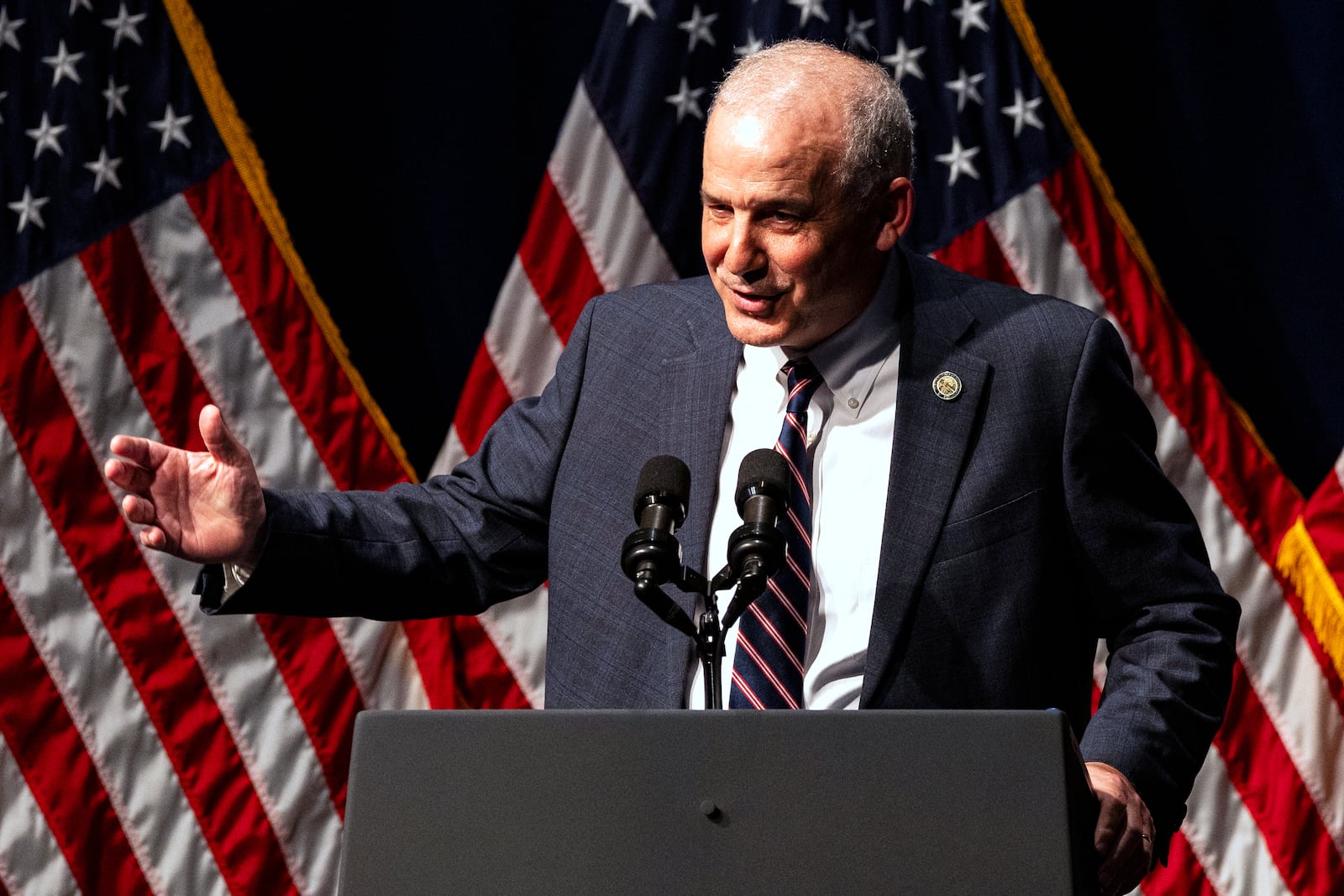

Speaking to a chamber Government Affairs breakfast briefing audience at the Engineers Club of Dayton, Huffman took aim at what he called “fragmented” government in Ohio, with some 6,500 local taxing authorities across the state hungry for taxpayer revenue — four times as many taxing authorities as California has, a state which is nearly four times as populous as Ohio, the speaker said.

“We have 608 school districts,” said Huffman, whose father grew up in West Dayton. “In Florida, they have 66, one for each county. And each one of those school districts cares about what’s going on in their school district; they don’t care what’s going on in Indian Hill or Cleveland ... they need money for their teachers now. And what that means is they’re going to have a levy.”

The problem isn’t new, even though some of the “symptoms” are, he added. Over the decades, especially since the 1970s, Ohio local government services funded by property tax levies have proliferated, he said.

Credit: AP

Credit: AP

“If you like the parks, it’s great,” Huffman said, citing one example. “But if you never go to the parks, if you think about it, why am I paying this?”

One reform measure, House Bill 186, would limit the tax rate for homeowners in school districts to the rate of inflation instead of growth in the real estate market.

The total amount of school levies can’t dip below 20 mills. Another bill, Ohio House Bill 129, includes additional taxes — such as emergency and substitute levies — in the calculation of that 20-mill floor, which Huffman called a “a check on tax hikes.”

The amount of money generated in 20 mills in a wealthier school district will outweigh the amount generated in a poorer district, Huffman noted. “The problem was, many of these levies weren’t counted toward the 20-mill floor, or weren’t counted toward how wealthy it made you look, including income tax levies,” he said.

But according to a September report by the Legislative Services Commission, 477 of 611 school districts were on the floor last year. The bulk of the districts are in rural areas and only 25 are urban school districts.

Citizens for Property Tax Reform has gathered signatures to amend the state constitution to eliminate property taxes. The group says it has collected well over 100,000 voter signatures to get a proposed amendment to ballots.

But doing away with about $24 billion in school and local government real estate taxes in one fell swoop would be destructive, Huffman argued.

“I have to say that the threat of a ballot initiative is part of the thing that’s driving this,” Huffman told the Ohio Capital Journal in October.

About the Author