Governor in region today

Gov. John Kasich is in Dayton today to discuss his tax plan. We’ll have complete coverage online at DaytonDailyNews.com and in Friday’s newspaper. Look for a special report on WHIO-TV Channel 7 starting at 5 p.m.

Also, we want to know what you would ask the governor about his plan, tell us at Facebook.com/daytondailynews

You can also find a list of what services will be exempt and included under the sales tax proposal on our website.

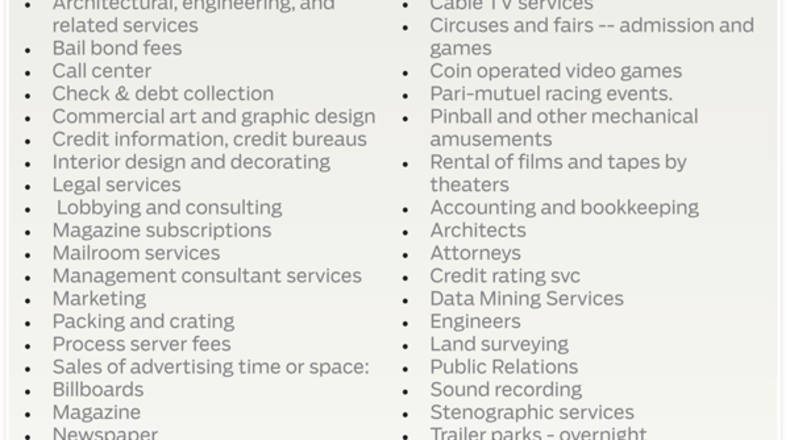

Goods and services that would be exempt and non-exempt from sales tax in Gov. John Kasich’s proposed sales tax expansion.

Ohio Gov. John Kasich wants to lower the state sales tax rate by half a percentage point, lower local sales tax rates by varying amounts and expand eligible goods and services to generate about $3 billion over three years.

Revenues from sales tax and higher taxes on oil and gas extracted from Ohio soil would fuel across-the-board income tax cuts.

Kasich plans to pitch his plan Thursday at Early Express, a Dayton company, with a panel of local business leaders and economic policy experts.

The Dayton Daily News obtained from the governor’s budget office a list of newly-taxed items including veterinary services, haircuts, sound recording services and magazine subscriptions among others.

The newly-taxed goods and services are expected to generate $2.6 billion in fiscal year 2015, the first year of full implementation.

Ohio first levied a sales tax in 1935 — 3 percent to support local governments and public schools at a time when poor economic conditions prevented people from paying taxes, according to the Ohio Historical Society. The rate increased to 4 percent in 1967, to 5 percent in 1981 and to 6 percent in 2003.

A permanent rate of 5.5 percent took effect July 1, 2005 and local governments have been allowed to levy taxes in addition to the state tax since 1967.

Myriad goods and services have been added to the list of taxable items throughout the years. Copying and printing services were added in 1959. Data processing and long distance communications were added in the 1980s. Lawn care, gym memberships and cleaning services became taxable in the 1990s.

Cable TV — proposed to be taxed in Kasich’s expansion — has been suggested in the past. The Department of Taxation decided last in 2004 that cable TV was a public utility service as described in state law and therefore should be exempt from tax.

Professional services have largely been left alone but would be taxed the proposed 5 percent state rate plus any county or transportation district tax.

Kasich said on Monday that cutting sales tax rates while expanding their application to fees for lawyers and architects would hit wealthier Ohioans hardest. But early critics of the plan aren’t sure poor Ohioans won’t feel the expansion more because they already pay a higher share of their income on sales tax.

And some of these professionals say the tax would also hurt banks and other businesses headquartered in Ohio that hire attorneys, accountants, architects and other professionals. Tony Ehler, a state and local tax attorney in the Columbus office of Vorys, Sater, Seymour and Pease LLP, said taxing services makes sense but could drive those businesses to use professionals in other states.

“There’s a reason our tax code is complicated — it’s a reflection of our society and our business,” Ehler said. “They put together a tax code to reflect a very sophisticated set of circumstances in our economy.”

About the Author