The company said the project depends on whether it also gets other state and local incentives.

FIRST REPORT: Defense firm proposes 250 new jobs in Miami Twp.

Cornerstone did not say at what address it is proposing this Miami Twp. project.

Documents by the tax authority say that tax incentives are so the company can manufacture batteries for the defense market.

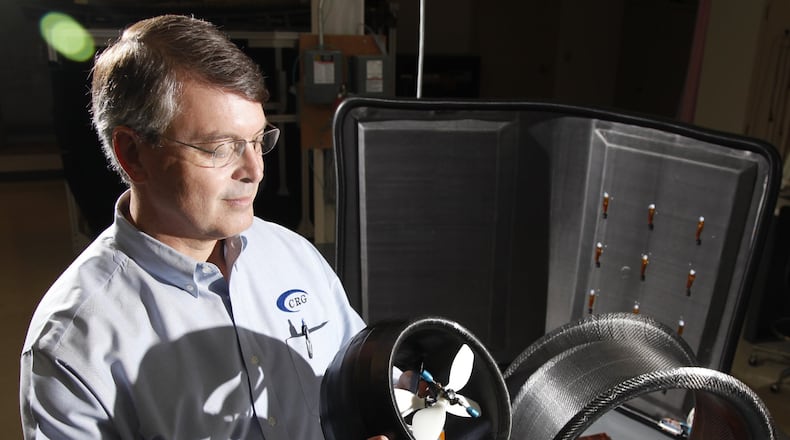

Cornerstone manufactures high-tech products and services for the aerospace, defense, and industrial sectors. The company said in a statement that the expansion would “would open new opportunities for a variety of high-skilled jobs in the Dayton region including software developers, aerospace engineers, electrical engineers, composite engineers, chemists, and manufacturing personnel.”

“The rapidly evolving Department of Defense acquisition landscape is creating significant opportunity for Cornerstone Research Group and the Dayton region,” Chris Hemmelgarn, vice president of strategic relations at Cornerstone Research Group, stated. “With multiple technology products progressing towards procurement, we are excited to work with the Dayton Development Coalition, JobsOhio, and partners throughout the state to rapidly develop and deliver new capabilities to the warfighter and contribute to the success of the Dayton region.”

The Ohio Tax Credit Authority announced Monday that the board approved a 2.101 percent, nine-year Job Creation Tax Credit toward the company keeping jobs in Miamisburg and the new project in Miami Twp. According to the state, the tax credit’s estimated value is $2.5 million.

As part of the tax credit agreement, the state requires Cornerstone to maintain operations at the project site for at least 12 years.

According to tax authority documents, the state was competing with sites in New Hampshire, Washington, D.C. and New Jersey for the proposed project.

PREVIOUS COVERAGE: Miamisburg approves income tax deal for Beavercreek firm to move to city

Cornerstone moved in November 2017 from Beavercreek Twp. to Miamisburg. Its corporate offices and most of its labs and development areas opened at a larger location at 510 Earl Blvd., Miamisburg. The site was formerly home to United Grinding North America.

At the time, Cornerstone was approved for a $225,000 grant to be paid out over five years to help fund the move, with funding through the Montgomery County Economic Development/Government Equity (ED/GE) program, which is county sales tax dollars shared among communities.

Chris Fine, city of Miamisburg development director, said the city has not had any significant discussion with Cornerstone about the project. However, he said that Cornerstone has been in growth mode since it moved to Miamisburg and city officials are glad to see that continue.

“Although these new jobs are not located in Miamisburg, it is likely that they will result in the need for additional employment at the Miamisburg location to support this potential second location for the company. The impact of that growth on Miamisburg is not known at this time,” Fine said via email.

MORE : Port Authority OKs $25M in bonds for fifth giant building near airport

Miami Twp. officials did not confirm the Cornerstone project, but public documents show they are talking with an unnamed local company that is seeking bring more than 100 “highly skilled” jobs to a dormant manufacturing facility on Washington Church Road.

Miami Twp. records refer to the proposal by the code name Project VOLTA. The company’s proposal includes a payroll of at least $7 million from technical jobs with full benefits, records show.

The unnamed company is seeking the township’s help in obtaining funds through the Montgomery County ED/GE incentive program for the move.