Strained by higher corn prices and other factors, Rex saw a diluted earnings per share loss of 32 cents for the most recent quarter.

MORE: Fuyao Glass America agrees to pay $1.3M in lawsuit settlement

The net loss attributable to Rex shareholders in the third quarter was $2.1 million, compared to net income of $11.9 million in the third quarter of 2018.

The company’s net sales and revenue for the most recent quarter were $86.7 million, compared with $123.8 million in the third quarter of 2018.

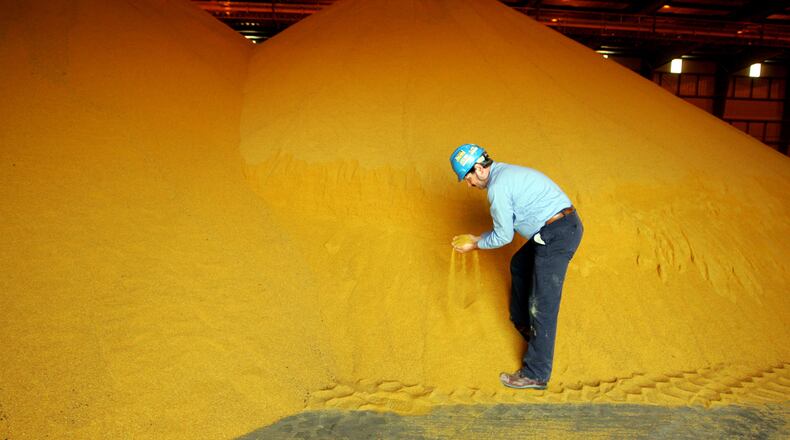

Although ethanol and corn oil pricing strengthened on a year-to-year basis, lower Q3 ’19 ethanol production and lower distiller grain pricing resulted in a year-over-year decline in net sales and revenue, the company said.

“Primarily reflecting these factors and a significant year-over-year increase in corn prices, the quarter’s gross profit for the company’s ethanol and by-products segment was $28,000, compared with $11.3 million in Q3 ‘18,” Rex said in a release Wednesday.

As a result, the ethanol and by-products segment loss before income taxes was $2.8 million in the third quarter this year, compared to income of $8.4 million in the same quarter last year.

The company’s refined coal operation incurred a $1.8 million gross loss and a $1.6 million loss before income taxes in Q3 ‘19, compared to a $3.5 million gross loss and a loss before income taxes of $4.2 million in Q3 ‘18.

Rex reported a Q3 ‘19 loss before income taxes and non-controlling interests of $4.9 million, compared with income before income taxes and non-controlling interests of $3.8 million in the comparable year-ago period.

Q3 ‘19 basic and diluted net loss per share attributable to REX common shareholders was $0.32, compared to net income per share of $1.86 in Q3 ‘18, the company said.

Shares of Rex (NYSE: REX) were trading down $2.32 at about $91.18 shortly before 10 a.m. Wednesday.

Rex’s One Earth Energy, LLC and NuGen Energy, LLC ethanol production facilities are consolidated, as is the company’s refined coal entity, while those of its four other ethanol plants are reported as equity in income of unconsolidated ethanol affiliates.

The company reports results for its two business segments as ethanol and by-products, and refined coal.

About the Author