Northmont’s new 7.82-mill levy request cracks the top five in the past decade, with only 7.9-mill levies in Franklin and Bethel in 2014 ahead of them.

And Vandalia-Butler is the first school district in the four-county area to put a full 1% income tax levy on the ballot in at least a decade.

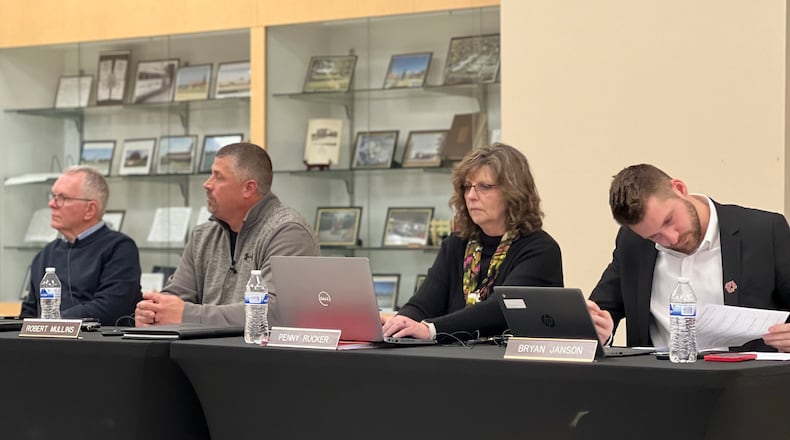

Huber Heights school treasurer Penny Rucker said her district is concerned about projected deficit spending in the next few years.

“We based the amount of the levy on the amount of money needed ($6.9 million) to continue the current level of services without the large compounding of deficit spending,” she said.

Recent levy history

Comparatively few local schools have sought tax increases for day-to-day operating expenses in the past few years. Multiple schools have been on the ballot for construction bonds instead, to build new schools.

And other districts are trying the relatively new “substitute levy” model, which doesn’t raise taxes on existing residents, but allows the schools to see future revenue gains when new homes are built.

Jeff Chambers of the Ohio School Boards Association said the likelihood of a school levy passing depends heavily on whether the district is asking voters to approve a new, additional tax, or to continue an existing tax.

“Over the last five years, renewals have a 91.5% passage rate, while levies generating new revenue have a passage rate of 45%,” he said, referring to statewide data.

Locally, Kettering and Bellbrook were the only districts to seek new day-to-day school operating levies across 2021 and 2022, and both of them passed.

Huber Heights levy

The Huber Heights City School District is seeking approval of the largest new-money school levy in the four-county area (Montgomery, Miami, Greene, northern Warren) in the past decade with its 8.12-mill levy request. The district already approved $1.7 million in budget cuts to begin next school year, to go along with the levy.

According to its five-year forecast, the district had $59.2 million in the bank last summer. That equaled about 75% of one year’s expenses, which is about double the statewide average, according to a recent Dayton Daily News study.

But Rucker has said Huber Heights schools need to improve their financial status, which is at risk based on upcoming years’ projected deficits.

The levy would cost the owner of a $100,000 home $284.20 per year and would generate $6.9 million per year in revenue for the schools, according to the Montgomery County Auditor’s Office.

Rucker said the levy “is solely intended to continue services at the current level,” rather than paying for additional programs or staffing.

The last time Huber Heights schools turned to the ballot for new money came from 2011-14, when the district tried six times to get voters to approve operating levies ranging from 5.95 to 8.0 mills (along with one income tax levy request). All were soundly rejected.

Back in 2008, voters did approve a 28-year, 6.92 bond levy for new construction and renovation of school facilities. That money cannot be used for day-to-day operations. The last new operating levy approved by voters was a 6.5-mill levy in 2005. That is among the longest gaps in new levy funding among the Dayton area’s larger school districts.

The last time a local school district sought a larger operating levy than Huber Heights’ upcoming one was in May 2013, when Fairborn schools asked for 11.7 mills, weeks after the state placed the district in “fiscal caution” status. Voters rejected that large levy, and it took the district two years to get out from under state oversight, largely via budget cuts and increases in state funding.

Credit: JIM NOELKER

Credit: JIM NOELKER

Vandalia-Butler levy

The Vandalia-Butler City School District is asking voters for an additional 1% earned income tax to fund daily operations. This request is the largest school income tax request in the past 10 years in the region of Miami, Greene, Montgomery, and northern Warren counties.

If approved, the levy will generate about $6.4 million per year and last five years, said Vandalia-Butler Treasurer Eric Beavers. For a person with $50,000 in annual taxable income, the levy would cost $500 a year.

Vandalia Superintendent Rob O’Leary said the funds would pay for the cost of daily operations, and in all local school districts, the No. 1 expense is employee salary and benefits. O’Leary said the levy would help fund the school safety officer program, middle school and high school electives and elementary classes like art and music.

O’Leary said the district has never previously used an income tax, though it’s been discussed. But this option allows flexibility in payment with inflation and job loss and doesn’t impact most senior citizens in the community, who may have trouble affording the property tax increases.

The district’s last operating levy that increased tax rates was 10 years ago. That 6.99-mill levy narrowly passed in 2013 after being rejected twice the previous year.

The Ohio School Boards Association said school income tax requests were down last year, with 28, compared to 53 in the last pre-pandemic year of 2019.

Northmont levy

The Northmont City School District is asking voters to approve a 7.82-mill levy. Among local school property tax levies in the past 10 years, that’s only smaller than the current Huber Heights request, and a pair of levies from back in 2014.

The 10-year levy is expected to generate $5.8 million yearly and would cost residents $273.70 annually per $100,000 of property value, according to the Montgomery County Auditor’s office.

Northmont officials said the levy would pay to “maintain the current programming” of the district, not add new features. Northmont district voters last approved a new money levy in 2016 (at 5.9 mills).

“We based the amount on what revenues will be coming from property taxes and the state budget, and reductions that could be made that would not affect programs that we have in place,” district spokeswoman Jenny Wood said.

Mad River levy

The district is seeking a 5.9-mill property tax increase for daily operating expenses in May, the first ballot issue in the Riverside school district since March 2012, officials said.

District leaders said a key reason for the levy is the projection of “significant” and growing budget deficits as federal COVID money runs out after next year. They have already outlined cuts — including 12 jobs — should voters reject the levy.

“The board does not want to overburden the community and felt that 5.9 mills, while more is actually needed, would be an acceptable amount to ask for at this time,” Superintendent Chad Wyen said.

The levy would cost the owner of a $100,000 home an additional $206.50 annually, and raise about $1.54 million a year, according to the county auditor.

Wyen said the decision to seek a tax increase before the next round of state funding is resolved was because the district’s forecast “assumed the current phase-in of the Fair School Funding Plan would continue as is, so state funding increases are already factored in.”

Proposed cuts should the levy fail are estimated at $1.48 million, more than $925,000 of which would involve job salaries and benefits, according to Mad River documents.

Wyen said federal COVID relief funds “did push back the need” for a levy, but the district cannot rely on them after 2024.

Fairborn bond

Fairborn is the other local school district seeking a funding increase, but theirs is not for day-to-day operations. Fairborn is seeking voter approval of a $24.6 million bond issue to finish construction of the new high school, restoring projects that were cut due to inflation and rising costs.

The bond issue is a 1.7-mill, 34-year tax that would cost the owner of a $100,000 home an extra $59.50 annually. The bulk of the high school was funded via a 5.83-mill bond issue that voters approved in 2020, plus money from the Ohio Facilities Construction Commission.

Rising costs prompted the district to delay some planned improvements — softball fields, baseball fields and tennis courts among them, district officials have said. The Commerce Center Boulevard project was once estimated at $70 million, but now projected at $82 million, officials have said.

District Treasurer Kevin Philo said collection of funds triggered by this vote wouldn’t start until January 2027, when a separate long-term tax issue expires.

Local schools’ levy history

This list shows the last time voters in each of the area’s 20 largest school districts approved a “new-money” school levy (not a renewal), for the purpose of day-to-day operating costs.

Some districts, including Fairborn, Franklin and West Carrollton, have passed separate bond issues, which are not on this list. Those are for the purpose of building new schools, and that money can’t be used for day-to-day costs.

Some districts have passed more than one “new-money” school operating levy in the past 10 years, including three each for Kettering and Oakwood, and two each for Centerville and Beavercreek. Kettering and Oakwood voters also separately approved facilities money in that span.

Under Ohio’s system, school districts considered wealthy have received less state funding and rely more on local levies. School districts considered poorer get more money from the state and less from local residents.

Kettering — 2022 (5.99 mills)

Bellbrook — 2021 (4.9 mills)

Oakwood — 2019 (4.99 mills)

Centerville — 2019 (6.9 mills)

Lebanon — 2019 (4.99 mills)

Beavercreek — 2019 (6.15 mills)

Northmont — 2016 (5.9 mills)

West Carrollton — 2016 (5.5 mills)

Tipp City — 2015 (4.95 mills)

Vandalia-Butler — 2013 (6.99 mills)

Franklin — 2013 (7.92 mills)

Mad River — 2012 (5.9 mills)

Miamisburg — 2010 (6.775 mills)

Dayton — 2008 (4.9 mills)

Fairborn — 2007 (8.6 mills)

Troy — 2006 (1.5% earned income tax)

Trotwood-Madison — 2005 (7.8 mills)

Huber Heights — 2005 (6.5 mills)

Springboro — 2005 (10.06 mills*)

Xenia — 2004 (7.9 mills)

* Note: Springboro’s 2005 vote was a combination levy; only 4.78 mills were new taxes.

Sources: County boards of election, local school districts