Cities rely heavily on income tax collections, but can fall back on reserve funds.

Income tax accounts for about three-fourths of Dayton’s general fund budget.

The City of Dayton collected about $133.6 million in income tax revenue in 2019, including about $11.25 million in March and $15.4 million in April, which was the highest tally of the year.

Cities like Springboro are better set to absorb the delay than some other cities, according to the city’s mayor.

“It hurts us obviously,” Mayor John Agenbroad said. “We’ve got to take care of our residents. At the end of the day, it’s taxpayers’ money.”

“It’s only three months. The government did it. We are going to do it.”

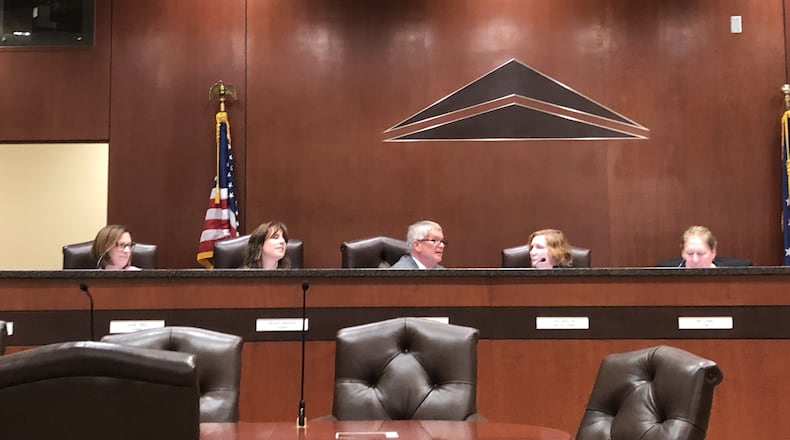

On Thursday, the Springboro City Council is expected to meet to vote to “mirror” the state and federal government, according to City Manager Chris Pozzuto.

Fairborn, Huber Heights, Trotwood, Xenia and Yellow Springs have already extended their local filing deadlines to July 15.

“In Xenia, our ordinances now tie our deadline to the state’s automatically, so once we have confirmation that the state has pushed back the deadline, we will begin to promote this change to our residents,” Xenia City Manager Brent Merriman said last week. “This relief was much needed, and we applaud the state for finally getting this done.”

MORE: Dayton, local governments say they will need a bailout

Before the Ohio Legislature’s vote, Miamisburg, West Carrollton had already pushed back the city income tax filing deadlines consistent with the federal deadline, according to those respective city’s websites.

After the state change, the City of Lebanon posted a notice: “The State of Ohio has taken legislative action, and now the City of Lebanon is able to extend the deadline for filing 2019 income tax returns to July 15, 2020, which is now consistent with the federal filing date.”

Beavercreek and Bellbrook have no local income tax.

In addition to the delay, local governments anticipate large decreases in local collections for income and other taxes and fees.

MORE: Flu and coronavirus: Same symptoms, different fears

Staff writer Cornelius Frolik contributed to this report.