On Tuesday, school districts and municipalities will ask citizens to renew or approve new levies. The new ones will cost homeowners more money, and the renewals, by in large, will keep tax bills about the same.

Some will see the levies as yet another governmental money grab, and that makes citizens furious.

But everyone should take a step back and unemotionally weigh the pros and cons of passing or rejecting a levy.

That’s tough, especially when voters remain furious over the increase in property valuations, which leads to an increase in taxes. Montgomery County, for example, has received valuation appeals on nearly 1,500 parcels so far, and the deadline for filing an appeal isn’t until April 1.

Still, there are long-term consequences for voting no. Research shows that the failure to pass school or fire levies, for example, often leads to lower home values.

That makes sense. Families want to live in communities that support improving education while investing in public safety that keeps them safe. They can move to any number of municipalities that share those values.

I get the arguments against any additional levies. Some believe that public servants are overpaid (I don’t) and municipalities hire too many people. They question the need to expand or build new schools and police stations or buy new equipment. Some believe voting yes on a school levy has no benefit to them because they no longer have children in the district (I hear that a lot).

But the biggest issue, as always, comes down to money. The Dayton Daily News and other cities still fortunate enough to have a daily newspaper list what levies will cost taxpayers. However, levies are complicated, and it takes work to understand the ins and outs of mileage, whether the levy adds additional taxes to bills, how long the levy will remain, whether the levy is a school operating or construction levy — and more.

So, if you’re on the fence about whether you’re a yay or nay, ask yourself questions that include:

- What’s the long-term impact on my property value if the tax increase doesn’t go through and community services need to be cut?

- How safe will I feel if the police or fire departments shrink?

- What’s the impact on my local schools? I may not have children in them, but I may have other family (grandchildren, nieces, nephews) that make use of those services.

- From a financial standpoint, how much additional money will I spend by approving the ballot measures? Do I find that cost-benefit analysis — spend money now for continued rising property values, which is how most Americans build generational wealth — in my favor?

Voters will decide what’s best for their communities and, by extension, what’s best for them. Hopefully, they’ll make that decision as rationally as possible.

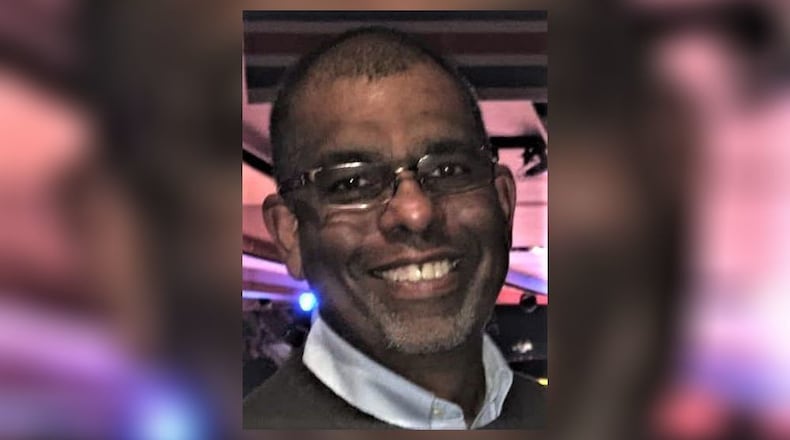

Ray Marcano’s column appears on these pages on Sunday.

About the Author