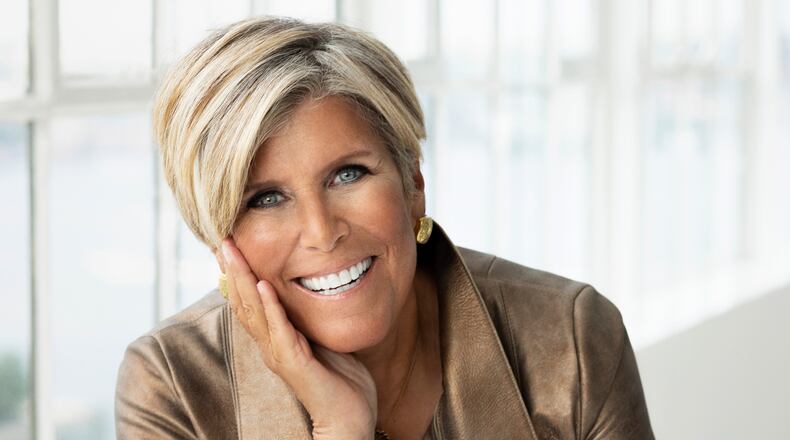

So we turned to nationally recognized personal finance expert Suze Orman for some possible solutions.

To start with, she told us, “women say yes to everybody but themselves.”

The host of Suze Orman’s Women and Money Podcast said many women contact her for help only after going through a breakup and realizing their finances are a mess.

“I have thousands of emails about this,” she sad, “Women say I have credit card debt for the first time in my life. I don’t have anything in savings.”

Alex Gailey, an analyst for Bankrate, agrees that part of the problem is the gender pay gap.

“Women earn 82 cents for every dollar a man earns,” she said,

A recent Bankrate survey found:

- 57 percent of women feel they are behind saving for retirement.

- 26 percent haven’t contributed to their accounts in a year.

Gailey says the data paints a troubling picture, with more women focusing their earnings on paying household expenses and citing a lack of confidence in investing.

“Women are trying to build wealth and secure their financial future in a system that wasn’t really built for them in the first place,” she said,

Gailey says the impact adds up to “hundreds of thousands of dollars over their lifetime.”

How to save more for the future

So what can you do?

“You need to put the financial oxygen mask on your face first if you really want to save your kids,” Orman said, in a reference to flight attendant instructions before a flight.

Orman says it’s important to pass on good financial habits to your children, especially girls.

So she suggests you start small., contributing a few dollars at a time.

“You get in the habit of saving, you get rewarded for it, and then you continue to do it,” Orman said.

Alex Gailey agrees, and encourages all women to take advantage of employer-sponsored retirement contributions, typically through a 401k, as well.

“You can secure financial freedom down the line,” she said, “so that you feel good when it’s time to step away from work.”

WCPO is a content partner of Cox First Media.

About the Author