Credit: FILE

Credit: FILE

Suburban Dayton attorney Ted Gudorf specializes in elder care and Medicaid planning while Miriam Sheline is the managing attorney for Pro Seniors Inc., a Cincinnati-based southwest Ohio organization educating older adults and their caregivers about the wide variety of legal and long-term care issues.

Medicaid provides health coverage to millions of Americans, including eligible low-income and elderly adults, as well as people with disabilities.

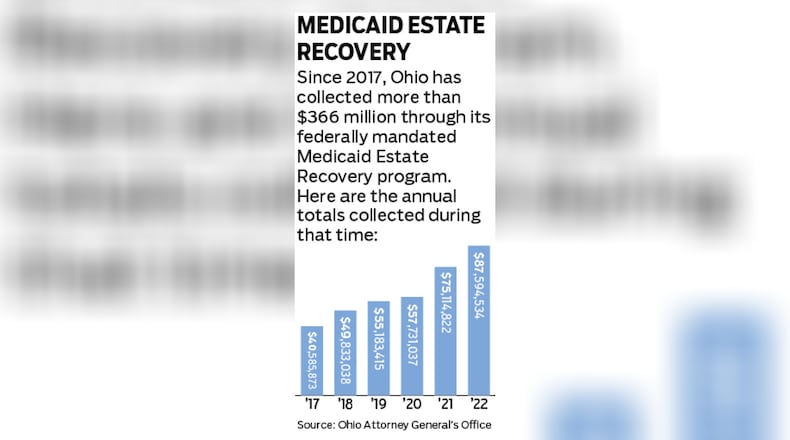

Medicaid Estate Recovery, which started in 1995, seeks to obtain repayment of the cost of benefits once a Medicaid recipient dies, according to the Ohio Department of Medicaid. Action is taken involving those who were either permanently institutionalized or age 55 years or older, state records show.

One option in avoiding Medicaid Estate Recovery involves finding a Medicaid legal specialist and creating a trust at least five years before applying for the health care benefits, as required by law, said Gudorf.

Protecting assets

“Assets that are transferred either to family members or to certain trusts are not counted for purposes of eligibility for long-term care Medicaid,” he said.

For example, Gudorf said, a person 60 years old who owns a house, has $100,000 in the bank and collects Social Security and a small pension can — for a “fairly modest” fee — create a Medicaid asset protection trust, to which they can transfer assets.

Credit: FILE

Credit: FILE

Medicaid will require them to pay an elderly care facility through their Social Security benefits and the pension, according to Gudorf.

“But (their) house and money can be protected,” he added. “That’s the real basic plan that most people should think about in terms of preplanning their affairs.”

But for those who don’t preplan, there is a “crisis” option in which about half of the assets can be saved, Gudorf said.

For an 80-year-old going into a nursing home with a $100,000 home, $100,000 in the bank, Social Security benefits and a pension, the law commonly requires the house to be sold to fund their care, Gudorf said.

Medicaid allows the creation of a trust, to which about half of their assets can be transferred, he added. “In every instance that we do crisis Medicaid planning, we’re able to save the family roughly 50% of their assets.”

Regional help

When an individual applies for Medicaid, they are provided with a form about the Medicaid Estate Recovery program, said Steve Irwin, press secretary for the Ohio Attorney General’s Office, which handles recovery.

While the form includes contact information for state staff who field questions, it can be often overlooked, Sheline said.

Her organization lists 18 attorneys on its legal team and provides many services for free. Pro Seniors’ attorneys have years of experience in elder law and a legal services help line “so any senior or family members who call for legal advice on a specific issue, we educate them on that,” Sheline said.

Appointments can be made at 513-345-4160.

While focusing on Butler, Clermont, Clinton, Hamilton and Warren counties, “we get thousands of calls across the state and mail out pamphlets on the issue,” she added. “Our in-house staff represents clients in southwest Ohio on issues, including estate recovery.”

The help line provides free legal information, advice, and referral for Ohio residents age 60 and over, regardless of income or resources, according to Pro Seniors website, proseniors.org.

About the Author