The effort has caused such a frenzy that one lawmaker has likened it to the “Sword of Damocles,” an expression that denotes impending doom.

Montgomery County Auditor Karl Keith and others have also warned of impending calamity if such an amendment were to pass.

“You’re talking about crisis, eliminating public services across the board, that would change what the community looks like throughout the state,” he told me in a recent phone interview.

That’s not hyperbole because getting rid of property taxes will hurt the people calling for their elimination.

Not the city, not the county, not the state.

You.

Cities, Keith explained, get revenue from income tax. The county gets its money from sales taxes. The state rakes in cash via personal income and other taxes.

But the services communities depend on would be decimated.

Schools get as much as half of their revenue from property taxes. Townships receive all of their income from property taxes, and that would dry up. Police and fire departments would lose their funding. The two Montgomery County human services levies, parks, and libraries all receive tax monies.

Montgomery County would have to raise its sales tax to 18.5% to cover the more than $1 billion the county would lose with property tax abolishment. An increase of that size won’t happen because a state law limits the sales tax to 8% and there’s no world in which lawmakers would approve such a massive hike.

Keith and other auditors have been travelling the state discussing the need for property tax reform. They see homeowners frustrated by a legislature that has never figured out how to fairly fund schools. Some frustration turns out to be from misinformation. A portion of voters believe the Ohio Supreme Court made property taxes unconstitutional, while others think lottery proceeds were supposed to replace property taxes.

And there’s the big one. Homeowners wrongfully believe that renters don’t pay property taxes, but they do because it’s a part of their rent.

“The difference is, it’s not obvious,” Keith said, “A homeowner sees it, right? A renter just goes, ‘Oh, my rent’s X number of dollars a month,’” and moves on.

The County Auditor’s Association favors a plan to expand tax relief for Ohioans 65 and over, eliminating a tax credit for for-profit business owners, limiting how much money schools can receive when property values increase, and offering tax relief to low- and moderate-income families.

That won’t eliminate property taxes, but it will help.

At a minimum, Citizens for Property Tax Reform has forged a sense of urgency among lawmakers who fear the Sword of Damocles. The Ohio House is proposing a mega property tax credit, and Gov. Mike DeWine’s task force studying property taxes may have recommendations soon.

Groups across the state need to keep the pressure on and not let lawmakers do what they’re apt to do — kick the can down the road when the pressure subsides.

Fixing the property tax system makes sense. Abolishing taxes does not.

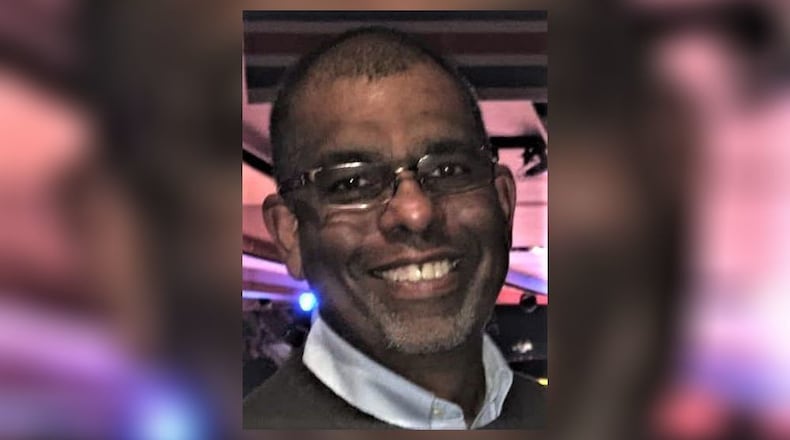

Ray Marcano’s column appears on these pages each month. The Ohio chapter of the Society of Professional Journalists named him best columnist in the state for 2024.

About the Author