For parents who normally get back a large refund, but received advance child tax credit payments in 2021, the amount of their tax refund may look lower on paper compared to previous years.

“For the advanced child tax credit, you’ve received, in theory, half of it already, but the good news is they increased the child tax credit for kids under six already,” said Josh Campbell, tax accountant with Bradstreet and Company. “So some people will reap the benefits of a healthy credit, especially if they had a child in 2021.”

For 2021, the child tax credit is fully refundable, meaning that instead of just reducing the amount of tax you owe, it can also result in a refund from the government. Historically, the refundable portion is limited based on income, but it is fully refundable for 2021 only, pending future legislation, Campbell added.

The situation gets slightly more complicated for unmarried parents, especially for those who trade claiming their children on their tax returns, as some parents may be required to pay that credit back.

The IRS determined Advance Child Tax Credit payments using data from 2021 tax returns. However, if one parent claimed a child on their 2020 taxes, and it’s the other parent’s turn to claim that child for 2021, the parent who claimed the child for 2020 may be required to refund their advance payments.

“The IRS has said in the past that if they overpaid on stimulus, ‘Our bad, you get to keep that,’” Campbell said. “For the advance child tax credit, that’s not the case. So your refund is going to get reduced, or what you would owe is increased.”

Taxpayers who received any of the Advance Child Tax credit payments should receive a letter from the IRS, titled Letter 6419, that documents how much of the credit they received. Experts say that is instrumental in making sure their return is processed on time.

“If it’s a married couple, both individuals will get one, showing the split‚” said Terry Krupp, director of tax and accounting at Laird’s Tax and Accounting. “It’s important to report exactly what was received, exactly what the IRS has in their file, because if not, the refund will be delayed. Not ‘may be,’ but will be.”

Working from home

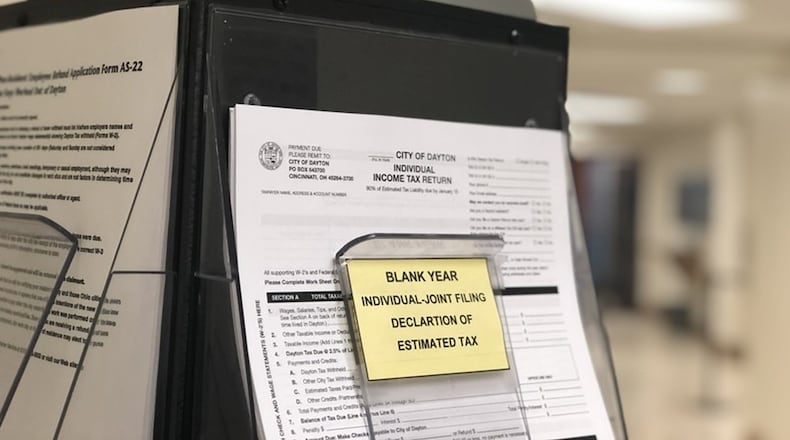

Taxpayers also may have an opportunity to save on city taxes if they worked from home in 2021, though the amount will vary depending on where they live.

In Ohio, people may pay taxes to both the city where they work and the city where they live, but residential cities often give credit to an individual for taxes paid to other cities. Cities must refund taxes withheld for employees who did not physically work in that city in 2021. But taxpayers who apply for and receive a refund must then pay taxes owed to their city of residence.

For example, a work-from-home employee who lives in Fairborn (2% tax rate), and whose employer is based in Dayton (2.5% tax rate), can apply to the city of Dayton to get the money that was paid to Dayton refunded to them. However, that taxpayer is now responsible for paying taxes due to Fairborn, with the difference as a small net gain.

Taxpayers who live and work in the same city will see little to no chance for savings, but taxpayers who live in a township or non-taxing city may see large benefits.

Stimulus money

Just like for the first two stimulus payments, those who didn’t receive their third stimulus check can also get it by filing a tax return. The IRS is also sending out a second letter, Letter 6475, to people who got their third stimulus check of $1,400. While that money isn’t taxable, it is still reported on a tax return to determine if a taxpayer is eligible for the money.

Cryptocurrency

Lastly, as more taxpayers are choosing to invest in cryptocurrencies, the IRS has cracked down in recent years on reporting crypto trades on taxes.

“It’s becoming more of a hot thing,” Krupp said. “More people are investing in it, and as people start to sell it, the government is going to want their share.”

Virtual currency is treated as property, according to the IRS. For most people, this works similar to traditional stocks. If all you did this year is buy cryptocurrencies, you don’t have to report it to the IRS. However, when trading cryptocurrency, using it to buy goods or services, or exchanging it for real money, taxpayers must recognize any capital gain or loss when cryptocurrency is sold.

“The difficulty lies in how you trade,” said Campbell. “If you’re using a platform like Coinbase or Robinhood, they’re doing a lot of work for you. If you’re doing decentralized exchanges, there’s other services that can do that. It’s very typical to do it like any other investment.”

General tax tips

With the IRS expecting delays, experts urged residents to file their taxes as early as possible, and to E-file when they can. Tax returns with no special situations should see refunds direct deposited into a bank account 21 days after the filing date, though claiming certain credits, like the earned income credit, means refunds could take longer.

“The IRS just started accepting returns electronically, which they recommend people do now more than ever,” Krupp said, adding that the government still has a backlog of paper returns from the pandemic. “Electronic filing will be fastest way to get their refund.”

How does the Advance Child Tax Credit Work?

The American Rescue Plan Act temporarily expanded the child tax credit for 2021 only, allowing 17-year-old children to qualify for the credit and increasing the credit to $3,000 per child (and $3,600 per child under six years old). For most people, this works out to $300 per month for kids under six, and $250 a month for each child over six from July through December.

This year, the child tax credit is also fully refundable for families who lived in the U.S. for more than six months in 2021, and a person can apply to get the credit even if they have no income.

Higher-earning families may not be able to claim this higher credit amount, however. The higher credit phases out at a modified adjusted gross income of $75,000 on single returns, $112,500 on head-of-household returns and $150,000 on joint returns, according to the IRS.

About the Author