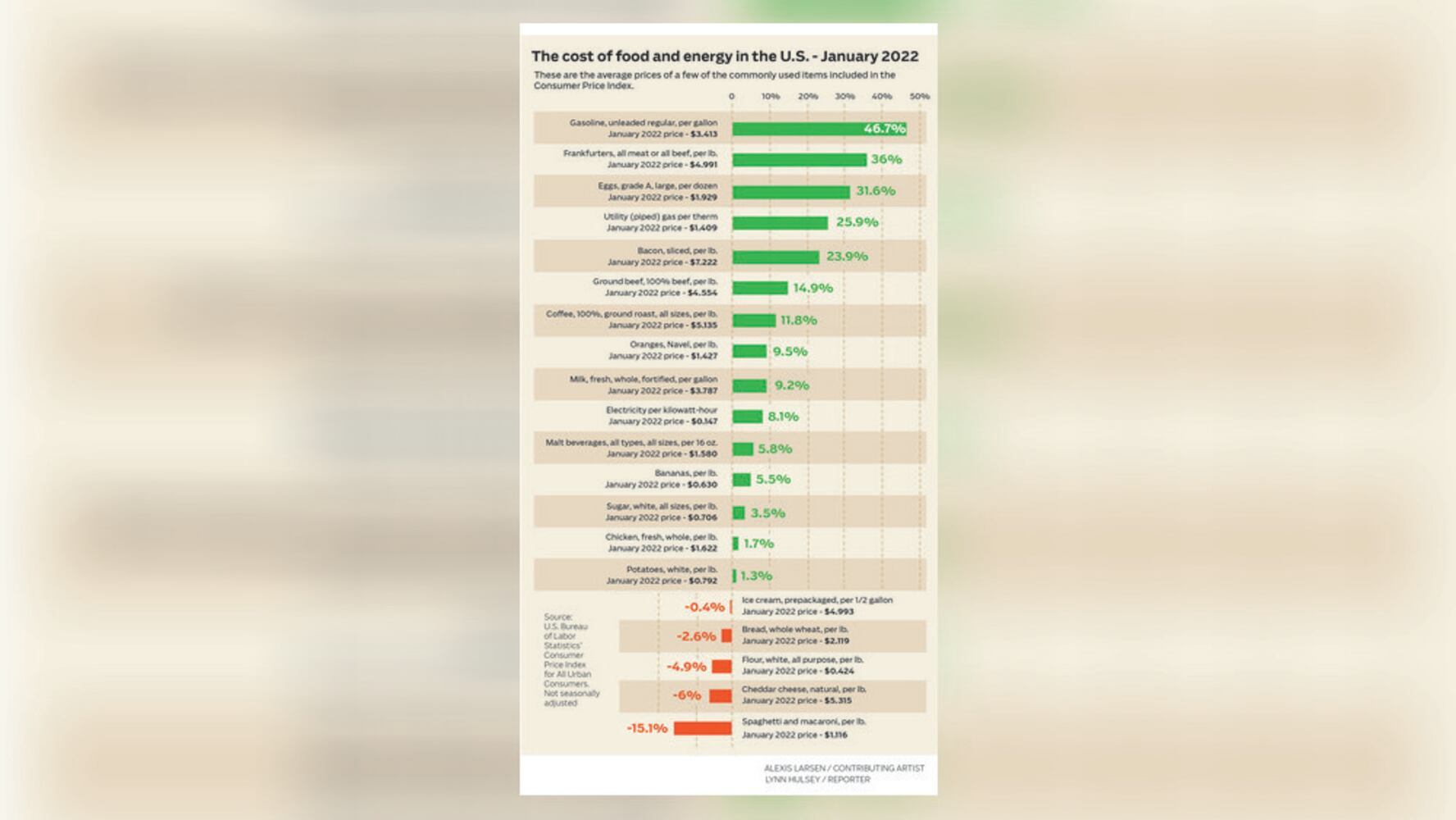

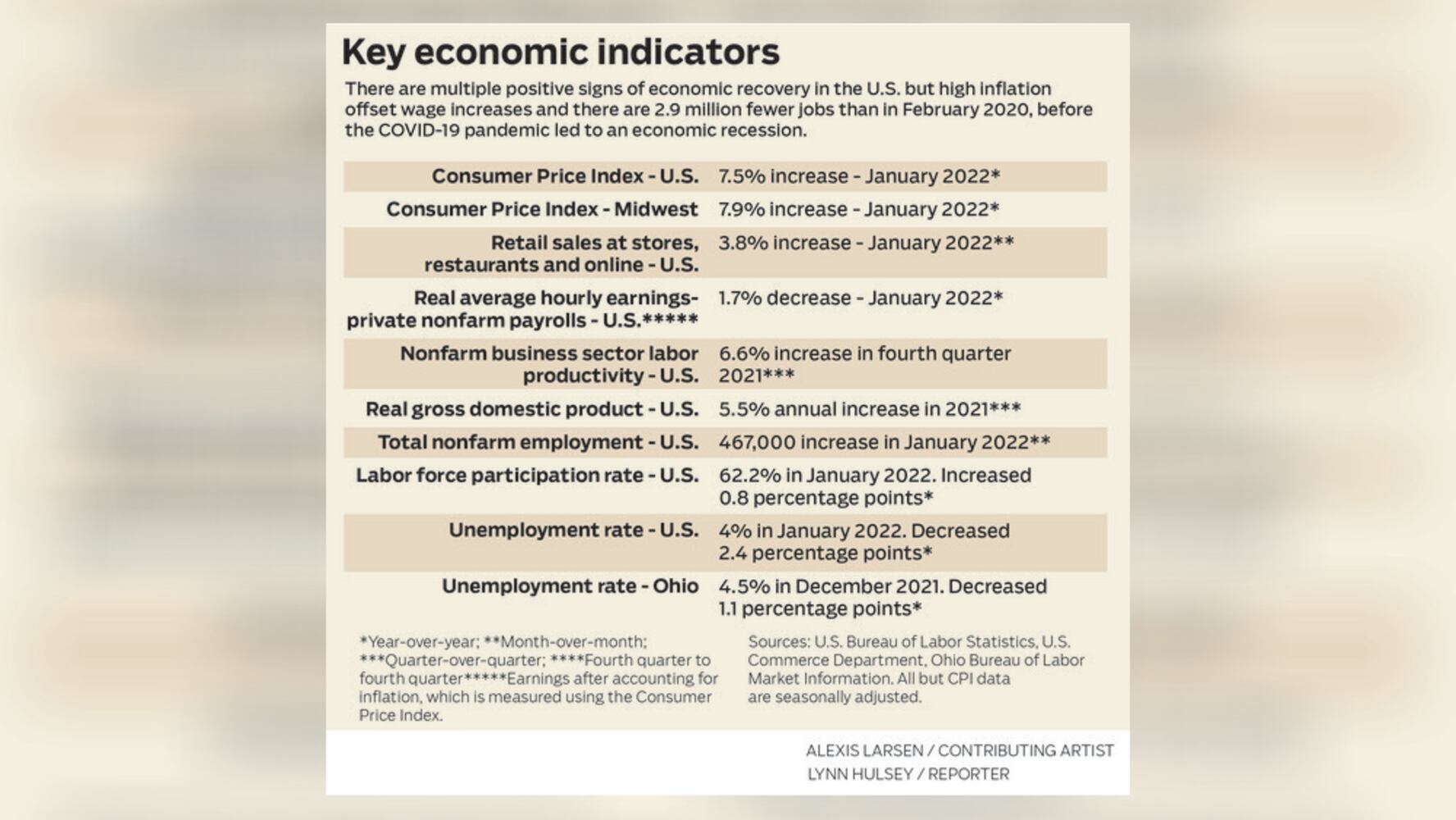

“If you are paying $200 more a month in groceries and you are paying an extra $4,000 to buy a car, those are the things I think the average American pays attention to,” said Kristen Bowser, a married, working mother of five children who lives in Springboro. “When you are making also the same amount but everything costs more, I think that’s where people really feel it. You feel it in your pocketbook.”

“Naturally, we are spending more on groceries, especially the people that’s on fixed income, on social security,” Springfield resident Becky Backus said, noting that her monthly grocery bill has increased by $150. “Prices are going up, so they have to cut back, then the utilities are going up. So I don’t know what people are going to do. I don’t know what people with big families are going to do, I don’t know how they’re going to make it. Something’s got to give somewhere.”

“It’s affecting us a little, not a lot. Prices have gone up but interest rates are remaining low. Builders have to pass those costs on to our buyers,” said Charlie Simms, president of Charles Simms Development of Dayton, which builds townhomes and other attached, maintenance-free homes in Dayton, Springfield, Beavercreek, Centerville and Lebanon.

“I’m an optimistic person so I always try to have an optimistic view of things. But there are certain things: raising interest rates slows home sales, and slows down machinery sales and slows down automotive purchases,” said Steve Staub, president and co-owner of Staub Manufacturing Solutions of Dayton “There are some concerns it will slow things too much, but it also helps contract inflation.”